Own or control a company? Many businesses now required to report information to FinCEN or face fines.

As of January 1, 2024, the Financial Crimes Enforcement Network (FinCEN) is requiring basic information by many corporations, limited liability companies (LLCs), partnerships, trusts, and other legal entities in hopes of preventing money laundering shell accounts.

CNS Licensing is here to help break this down and possibly handle this process on your behalf.

What is BOIR and why is this happening?

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

In 2021, Congress passed the Corporate Transparency Act that created a new beneficial ownership information reporting requirement.

The new requirement is part of the U.S. government’s efforts to make it harder for criminals to hide from any illegal activity, which in this case involves the laundering of money through a shell company or other opaque ownership structure.

For some time, organized crime has found a way to function by creating small businesses that operate as a front or a shell company so they can launder money. The money is being laundered through a legitimate business to “clean” it, if it was earned from some other illegal activity, like human trafficking operations, drug trade, etc.

These businesses are illegal, inhumane, and undermine the economic growth and security of the United States.

While the Beneficial Owner Information Report process will not singlehandedly stop illegal business interactions, it is a step in the right direction to make such business far more difficult. In the end, it will protect business growth and the well-being of civilians.

Do I need to do this BOI report? Who is a beneficial owner?

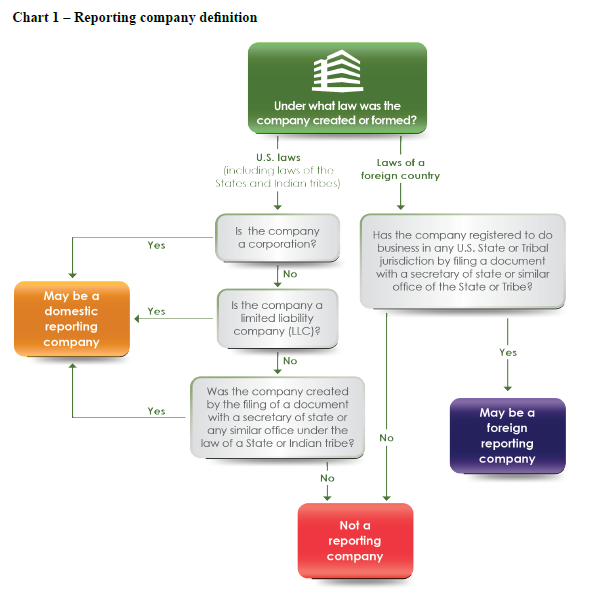

Not all companies are required to report BOI to FinCEN under the Reporting Rule.

Companies are required to report only if they meet the Reporting Rule’s definition of a “reporting company” and do not qualify for an exemption.

Who needs to do this?

FinCEN uses 3 main requirements to determine who must report:

- A corporation, a limited liability company (LLC), or group otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe

- with less than 20 employees AND

- less than $5,000,000 in gross receipts or sales

- NOTE: This DOES NOT include Sole Proprietorship companies

- A foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

- Beneficial owners in the company.

- They generally exercise “substantial control” over a reporting company or own 25% of the ownership interests

So, first, you need to determine if you fall into the category of a “reporting company”. Look at the chart below, which can help determine if you are considered a domestic or foreign reporting company.

After this, your next step is to identify its beneficial owners. A beneficial owner is any individual who, directly or indirectly:

- Exercises substantial control over a reporting company; OR

- Owns or controls at least 25 percent of the ownership interests of a reporting company.

Note: A reporting company can have multiple beneficial owners.

For example, a reporting company could have one beneficial owner who exercises substantial control over the reporting company, and a few other beneficial owners who own or control at least 25 percent of the ownership interests of the reporting company. A reporting company could have one beneficial owner who both exercises substantial control and owns or controls at least 25 percent of the ownership interests of the reporting company. There is no maximum number of beneficial owners who must be reported.

Need help filing the BOIR? CNS Licensing Can Help!

Our CNS Licensing team can help you do this process on your behalf. If you are interested, fill out the form below… otherwise call us at (888) 260-9448 or email at info@cnsprotects.com.

Who is exempt?

There are 23 types of entities that are exempt from BOIR requirements (learn more here). These are:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

What penalties do individuals face for violating BOI reporting requirements?

As specified in the Corporate Transparency Act, a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues.

That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000.

Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

When do I need to file a report?

Reports will be accepted starting on January 1, 2024, but the deadline for reporting does vary:

- Existing reporting companies registered to do business before January 1, 2024

- Deadline to file their initial BOI reports is January 1, 2025

- New reporting companies registered between January 1, 2024 and January 1, 2025

- Deadline to file their initial BOI reports is 90 calendar days after receiving actual or public notice that their company’s registration is effective.

- NOTE: Specifically, this 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

- Reporting companies registered on or after January 1, 2025

- Deadline to file their initial BOI reports is 30 calendar days after from actual or public notice that the company’s registration is effective

What information is collected for BOIR?

Below are some required information for the BOIR:

- Reporting Company Legal Name/Alternative Names

- Form of Identification (Tax ID)

- Jurisdiction of Formation or First Registration

- Current US Address

- Company FinCEN ID (if available)

- Current Address

- Form of Identification and Issuing Jurisdiction (will be uploaded)

Updating changes in reported information

In addition to filing an initial BOI report, reporting companies must also update and correct information (within 30 days) in their previously filed BOI reports and individuals who obtain FinCEN identifiers must also update and correct information previously reported to FinCEN (within 30 days).

Need help filing the BOIR? CNS Licensing Can Help!

Our CNS Licensing team can help you do this process on your behalf. If you are interested, fill out the form below… otherwise call us at (888) 260-9448 or email at info@cnsprotects.com.