Fuel Tax Services

IFTA, HUT, HVUT

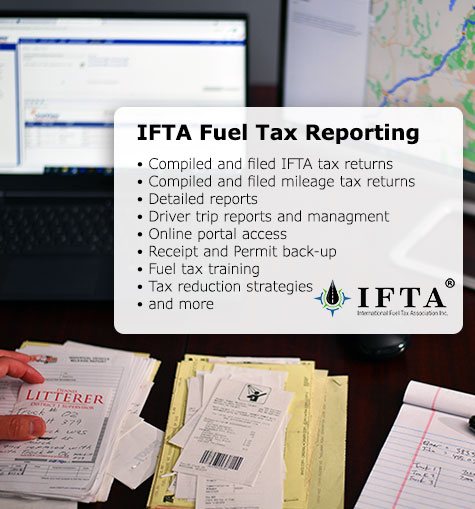

Stay compliant and avoid costly penalties with our Fuel Tax Services. We simplify reporting for fleets by covering:

Who does it apply to?

IFTA Fuel Tax Reporting is required in your base state for carriers or operators of qualified motor vehicles, most commonly truckers, used in interstate operations.

Fuel Tax RATES

See what the current fuel tax rates are in your state on the International Fuel Tax Association (IFTA) website.

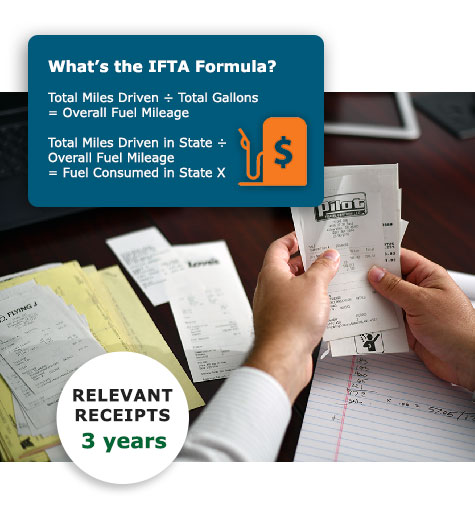

How do we perform this service?

Fuel Tax Management

Our IFTA Fuel Tax Specialists will work with you to collect your data, ensure your fuel and mileage match, prepare your filings and even file the paperwork for you.

- Compile and file completed IFTA tax returns on time

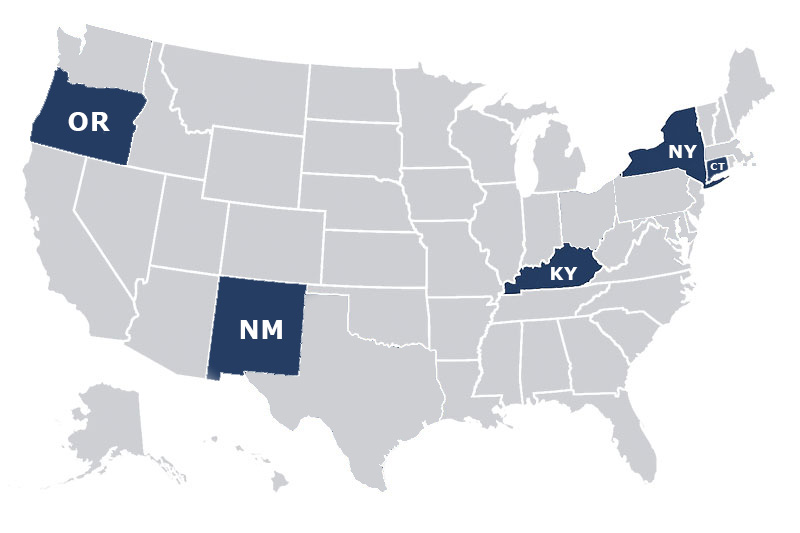

- Compile and file Mileage tax returns for KY, NM, NY, and OR

- Detailed MPG Reports by Truck, Division, and Fleet

- Paper driver trip reports, or “paperless” (GPS) data management

- 24/7 access to our online portal to see past IFTA filings

- Online backup for fuel receipts and trip permits.

- Fuel tax training and Tax reduction strategies

What do we need from you?

We work with many different fuel card vendors and can pull the reports for you.

We will pull GPS reports from your GPS Vendor to accurately calculate your fuel taxes

We offer base state reporting of fuel taxes for operators of qualified motor vehicles, most commonly truckers, used in interstate operations.

When carriers have a person or company act on behalf of them to file their taxes, a Letter of Authority must be submitted.

Get a Fuel Card and Save!

Getting a fuel card means you save money on every fill up, simpler and more streamlined IFTA Reporting, and more!

Need help with a Fuel Tax Audit?

IFTA Audit Representation

An IFTA Audit Specialist can help prepare your company for an IFTA audit as well as represent you during the IFTA audit. We take many specific steps in preparing you for the audit.

Highway Use Tax (HUT)

What is a HUT?

This is a state tax required for heavy vehicles operating on public highways, such as in New York. It’s based on the vehicle’s weight and miles traveled, ensuring that trucks contribute to the maintenance and repair of the roads they use.

Who does it apply to?

If you ever plan to travel through these five states (KY, NM, NY, OR, and CT), you must have an account and file your mileage. There are unique rules, exemptions, registration requirements for each of these states. Our team of Compliance Specialists help you get licensed quickly and accurately.

HUT States

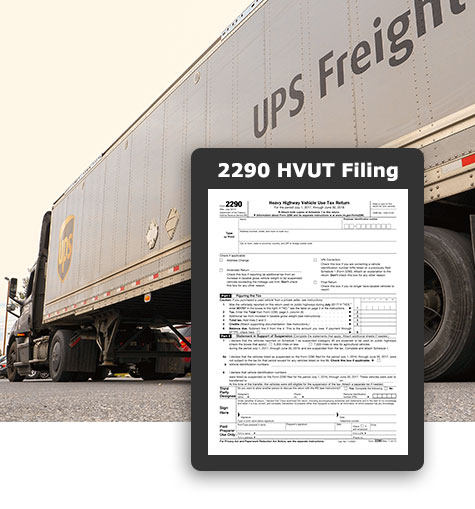

2290 Heavy Vehicle Use Tax (HVUT)

What is a 2290 HVUT?

Filing your 2290 means that you are reporting on and paying the Heavy Vehicle Use Tax for vehicles having a taxable gross weight of 55,000 pounds or more that are being operated on public highways.

Who does it apply to?

Truckers with a vehicle that has a taxable gross weight of 55,000 pounds or more, are required to electronically file HVUT Form 2290. Once filed you need to get a stamped copy of your Schedule 1. You must file all taxable highway motor vehicles that are required to be registered in your name; under State, District of Columbia, Canadian, or Mexican law, during the tax period of when the truck is first operated.

How do we perform this service?

E-File your 2290

We can E-File your 2290 on your behalf and make it easy and quick to get your Schedule 1 prepared and reported with the IRS. The stamped Schedule 1 proof will be sent to your inbox right away.

What do you need to complete a 2290 HVUT Form?

- Business Name

- Address

- EIN (Employer Identification Number)

- Details of an authorized signatory

- Vehicle Details (VIN, Weight)

Why Businesses

Choose CNS Licensing

CNS Licensing—handling the specialty vehicle paperwork, so you can focus on business.

- Specialized support for ag businesses, fleets, and dealerships

- PennDOT-authorized processing handled in-house

- Time savings that keep your vehicles moving and earning